Intel Announces Q3 FY 2018 Earnings: Record Quarter

by Brett Howse on October 25, 2018 6:50 PM EST- Posted in

- CPUs

- Intel

- Financial Results

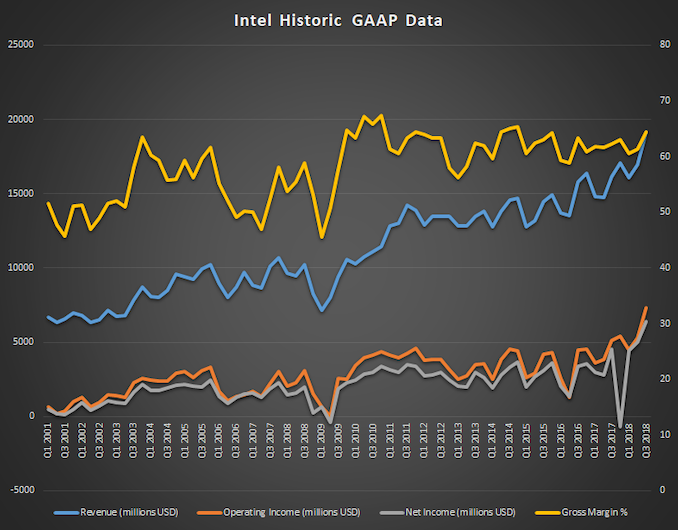

This afternoon, Intel announced their earnings for the third quarter of their 2018 fiscal year. Revenue was at a record level compared to any previous quarter, coming in at $19.2 billion, which is a gain of 19% compared to Q3 2017. Gross margin was up 2.2% to 64.5%. Operating income was up 43% to $7.3 billion, and thanks to a tax rate of just 10.4%, net income was up 42% to $6.4 billion. This resulted in earnings per share of $1.38, a gain of 47% from a year ago.

| Intel Q3 2018 Financial Results (GAAP) | |||||

| Q3'2018 | Q2'2018 | Q3'2017 | |||

| Revenue | $19.2B | $17.0B | $16.1B | ||

| Operating Income | $7.3B | $5.3B | $4.9B | ||

| Net Income | $6.4B | $5.0B | $4.5B | ||

| Gross Margin | 64.5% | 61.4% | 62.3% | ||

| Client Computing Group Revenue | $10.2B | +17.2% | +16% | ||

| Data Center Group Revenue | $6.1B | +11% | +26% | ||

| Internet of Things Revenue | $919M | +4% | +8% | ||

| Non-Volatile Memory Solutions Group | $1.1B | flat | +21% | ||

| Programmable Solutions Group | $517M | -4% | +6% | ||

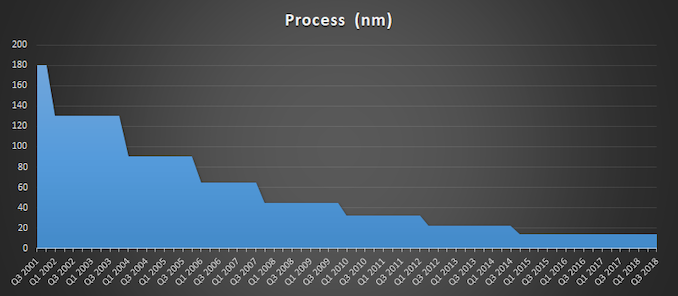

Intel saw gains across its lineup, despite setbacks on the manufacturing side which have stalled the company at their 14 nm process for several years. The Client Computing Group had revenues of $10.2 billion for the quarter, which is up 16% from a year ago, and operating income was up 26% to $4.5 billion. Intel attributes this growth to continued strong growth in the gaming sector, as well as commercial demand. Intel now puts their modem business into the Client Computing Group, and almost certainly thanks to a design win in a certain smartphone from Cupertino, Intel had growth of over 66% in their modem business, which had revenues of $1.2 billion this quarter. Revenue from notebook processor sales increased 13%, and desktop revenue was up 9%, with Intel overall growing PC volumes by 6% year-over-year. Considering the strong competition right now, that is quite impressive.

The Data Center Group continues its upward trajectory as well, with revenues up 26% to $6.1 billion for the quarter. Operating income grew 37% to $3.1 billion Looking at segments, Intel’s Cloud SP segment grew revenue by 50% year-over-year, and Comms SP was up 30% as datacenters evolve to software defined networks. Intel sold 15% more units in their Data Center Group, at 10% higher average selling prices.

The IOT Group had revenues of $919 million, which is up 8% from a year ago, while operating income grew 120% to $321 million. Non-Volatile Storage was up 21% year-over-year to $1.1 billion, thanks to growth in datacenter and Optane sales, and Intel is transitioning to 64-layer NAND for SSDs, with over 50% of sales now being this type. Operating income was up 408% as Intel earned $160 million from this group this quarter, compared with a $52 million loss last year. Programmable Solutions was up 6% year-over-year to $496 million, although operating income was down slightly at $106 million.

Intel is still promising 10 nm by holiday 2019, but as to what that ends up being is hard to say now. There’s little doubt the company has struggled to move past their 14 nm node, despite increasing R&D spending by 11% since 2015. Originally, they were targeting 100 million transistors per square millimeter, but it’s possible they’ve reset their expectations.

Looking ahead to Q4 2018, Intel is expecting revenue of $19 billion, and they have raised their full-year outlook to expect $71.2 billion for FY 2018.

Source: Intel Investor Relations

36 Comments

View All Comments

Alistair - Thursday, October 25, 2018 - link

Interesting to see such incredible earnings. My stocks are down about 7 percent across the board in the last month, but clearly that is disconnected from these earning reports due to monetary policy and changes. Microsoft, Intel, even Tesla, all ridiculously profitable right now. Reading the Intel report is kind of shocking for me actually. Unlimited demand for expensive CPUs right now.HStewart - Thursday, October 25, 2018 - link

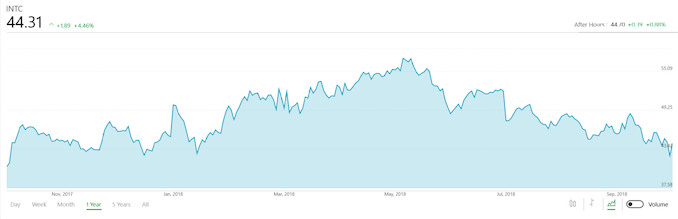

That is funny if you look at last month - it pretty much the same, but more importantly is since Nov 2017 which was likely the beginning of this Spectra/Meltdown stuff and about the same, yes it went up during that time and down last Summer when AMD went uphttps://www.bing.com/search?q=intc+stock&form=...

You last line gave yourself away, it is obviously you don't have Intel stocks. Possibly AMD which make your statement true. But not down as bad as just Today.

https://www.bing.com/search?q=AMD+Stock&filter...

TheJian - Friday, October 26, 2018 - link

What are you talking about the OP last line? His stocks being down 7% is probably true (likely talking avg of them all, about like everyone), and if you owned intel for the last Q you're probably far worse than him. June 6 Intel was $57.03, it's ~45 today. That is a major hit. Still not a bad stock if you've owned it all year I guess, you went from 41 (jan) to 45 (today). Still 10%, beating banks, most funds etc and you add on the DIV too! I believe you should sell on any big gain for INTC in the next Q or 2 as they will go down all year next year with 7nm vs 14nm server/desktop/mobile. That will be rough pricing for Intel (kills margin/net income etc), or they will lose a lot of share and that's not so good when the other guy will likely be selling BETTER chips at 7nm in almost everything. IE, games may catch up where AMD ties or wins all, instead of down ~10% basically over many games avg. They already do VERY well on the app side.You have no idea when he bought etc either. His actual last line could just mean he's surprised they could sell pretty much ONLY higher end stuff (they moved production massively to server/hedt top end stuff, shorting the low end according to their report), and still make a record Q. Yeah, might seem surprising to many that you can sell yet more ultra expensive chips in down sales years. We went from 384mil down to what 250mil pc units now? Huge drop yet intel/nv both sell high end massively and make bank doing it. NV didn't even sell a card below 1070/1080 for well over a year because AMD went low only...MORONIC management should be fighting for the top 80% of the PROFIT, and only the rest if forced by salvage etc. If I have a choice of selling a HEDT or low end apu crap cpu, I'll ALWAYS sell the higher margin top end products first and forever if I can...LOL. Business 101. If you can't sell those any more, THEN you make junk under $200.

Just quit pricing products wrong (too low) and stop using products like HBM/HBM2 that kill margin/sales due to shortages (too difficult to pump it out). Go fast enough (GDDR5x for both those) for top end unless you can PROVE HBM/2 are major differences in perf. If it's just expensive for ZERO gain, you're wasting profits.

Would you sell a car with 8 tires instead of 4 if they did nothing? No point, just wasted margin/income. Bandwidth on HBM1/2 wasn't worth mentioning as it does nothing so far or NV wouldn't win everything...LOL. 4k doesn't mean squat today, next they'll claim 8k is where you should run our card to show HBM2 works! HAHAHAHA. Whatever, slap GDDR5x (whatever top speed rung is for next cards) on next gen and pump the crap out of them EASILY and CHEAPER. Then charge like NV and bank 50-60% margins with a billion dollar quarter if you do the same on cpu side (charge what they are worth!). If you win, you PRICE HIGH. PERIOD. Or you failed. Make hay...

sa666666 - Friday, October 26, 2018 - link

Don't bother wasting your time explaining logic to HStewart when it comes to Intel. They can do no wrong. And AMD can do no right either; they must have either killed his cat or beat his grandma or something. Really has a stick up his ass about it.HStewart - Friday, October 26, 2018 - link

Just exchange HStewart with non-AMD and that is you statement.All I am doing is theorizing on why AMD stock is sinking and why Intel is rising. Reality is not in gaming machines, Microsoft knows it with 896 core server.

If you notice by Intel own reports - the price of desktop cpus - actually went down - that is what we can call the AMD effect on Intel. Thanks AMD for reducing Intel prices.

close - Monday, October 29, 2018 - link

All you're doing is trolling. And sad thing is that you're not even good at it.HStewart - Thursday, October 25, 2018 - link

I think what is most interesting is to look at volumes and prices of desktop and notebookshttps://www.intc.com/investor-relations/investor-e...

To me it looks like notebooks increase by 5% and desktop decrease by 5% for 2018 Q3 vs 2017 Q3 But oddly for Q3 vs Q2 Intel saw increase 12% for notebook and 15% desktops. Intel also had a 1% drop in desktop price.

I have no indication of Desktop vs Notebook percentage but it likely very low, but AMD appears to help Intel - especially in Q3.

DanNeely - Thursday, October 25, 2018 - link

the q2 vs q3 jump happens every year, it's called "back to school", there'll be another increase from Q3 to Q4 called "christmas", and then a slump in consumer spending for the next two quarters.HStewart - Thursday, October 25, 2018 - link

I can see that for notebooks, but desktops are hardly desire anymore - especially since you can not take a huge desktop to class room. That part could explain why notebooks got increase why desktops got decrease. But what about 15% increase in desktops - maybe because they got 1% decrease in cost. A would think new 8th gen desktop chips helps.danjw - Friday, October 26, 2018 - link

I expect that a lot of recent desktop sales has to do with the increase in core count in CPUs. At least for gamers and professionals that can benefit from the additional threads. Admittedly, most games cannot support more than 4 threads, if you like to keep other stuff running while you play, it can make a difference.