AMD Q3 FY 2014 Quarterly Earnings Analysis - 7 Percent Workforce To Be Cut

by Brett Howse on October 16, 2014 6:30 PM EST

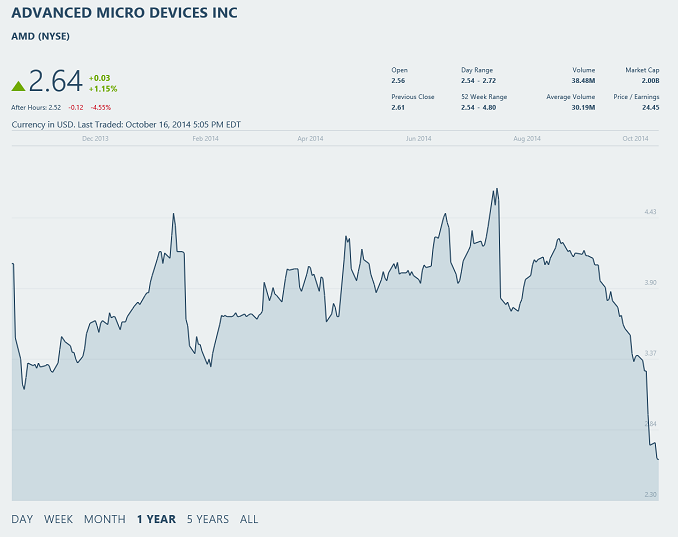

This afternoon, AMD released their financial results for the third quarter, which ended September 27, 2014. While revenue was down slightly from Q2, the net income was positive for this first time this fiscal year. non-GAAP Earnings Per Share was $0.03, which missed analysts’ projections of $0.04. Earlier in the quarter projections were as high as $0.07 per share, but the Computing and Graphics segment was mixed this quarter due to “challenging market conditions” according to AMD.

Starting July 1st, 2014, AMD reorganized their reporting structure into two groups. The Computing and Graphics group focuses on desktop and notebook processors, chipsets, discrete desktop GPUs, and workstation GPUs. The Enterprise, Embedded, and Semi-Custom group includes server processors, embedded processors, dense servers, semi-custom SoCs, engineering services, and royalties, which is pretty much every market AMD is in other than the traditional desktop/notebook market.

| AMD Q3 2014 Financial Results (GAAP) | |||||

| Q3'2014 | Q2'2014 | Q3'2013 | |||

| Revenue (Billions) | $1.43 | $1.44 | $1.46 | ||

| Operating Income (Millions) | $63 | $63 | $95 | ||

| Net Income (Millions) | $17 | -$36 | $48 | ||

| Earnings Per Share | $0.02 | -$0.05 | $0.06 | ||

Revenue for Q3 2014 was $1.43 billion, down just under 1% from Q2 2014’s $1.44 billion. As compared to Q3 2013, revenue was down 2%. Operating Income was $63 million (non-GAAP $66M) for the quarter, which is also down from the previous quarter and year-over-year. Net income was $17 million (non-GAAP $20M) for the quarter which is up from the $36 million loss last quarter, but down from $48 million profit in Q3 2013. Gross margin was flat from last quarter at 35%.

| AMD Q3 2014 Financial Results (Non-GAAP) | |||||

| Q3'2014 | Q2'2014 | Q3'2013 | |||

| Revenue (Billions) | $1.43 | $1.44 | $1.46 | ||

| Operating Income (Millions) | $66 | $67 | $78 | ||

| Net Income (Millions) | $20 | $17 | $31 | ||

| Earnings Per Share | $0.03 | $0.02 | $0.04 | ||

The Computing and Graphics segment revenue decreased 6% from last quarter and 16% year-over-year. AMD states the primary decrease is due to by lower chipset and GPU sales as compared to last quarter, and decreased notebook processor and chipset sales as compared to a year ago. The Operating Loss for the division was $17 million, which is up (or down, depending on how you look at negative numbers) substantially from the $6 million loss last quarter and $9 million loss in Q3 of last year. The Average Selling Price (ASP) of CPUs/APUs actually increase sequentially and year-over-year. Discrete GPU ASP decreased over last quarter, but increased over the same period last year. The Computing and Graphics segment is a tough market for AMD right now. Intel is moving to 14 nm while AMD has to rely on Global Foundries and other fabs to attempt to catch up. This hampers their ability to match Intel on the performance per watt metric certainly. On the GPU front, NVIDIA just released the Maxwell based GTX 980 and 970, as well as the mobile counterparts which have shown impressive performance, and efficiency. Hopefully AMD can counter with some new products in the near term.

The Enterprise, Embedded, and Semi-Custom division fared much better for Q3, with a 6% sequential gain in revenue and 21% year-over-year. Operating income for the quarter was $108 million which was up from the $97 million of Q2, and $92 million of Q3 2013. As with the last couple of quarters, AMD attributes the gains primarily due to increased sales of semi-custom SoCs. Their embedded revenue grew by “double digits” as compared to last quarter. Clearly AMD has found a niche here where they can use their expertise in new markets to shore up the company, and so far, it has been successful. In addition, AMD has closed two new Semi-Custom SoC designs this quarter which should help this division continue its growth.

| Results Per Division | |||||

| Q3'2014 | Q2'2014 | Q3'2013 | |||

| Computing and Graphics Revenue (Millions) | $781 | $828 | $925 | ||

| Computing and Graphics Operating Income (Millions) | -$17 | -$6 | $9 | ||

| Enterprise, Embedded, and Semi-Custom Revenue (Millions) | $648 | $613 | $536 | ||

| Enterprise, Embedded, and Semi-Custom Operating Income (Millions) | $108 | $97 | $92 | ||

In addition, AMD is also trying to cut costs by reducing their workforce by about 7% Currently, they have 10,149 employees as of the end of Q3, which means around 710 people will be cut from the company. Most of these cuts should be done by the end of Q4. AMD will then adjust their real estate footprint to accommodate the smaller workforce, which could mean additional infusions of cash from the sale of buildings. They are hoping to have savings of $9 million for Q4 and $85 million for FY 2015.

Their forecast for Q4 is not rosy either. AMD is expecting revenue to decrease 13% from Q3, plus or minus 3%. However they are also hoping to drop expenses from the current guidance of $420 to $450 million, to $385 million, which means they are hoping for a positive non-GAAP free cash flow.

Although AMD did miss investor earnings, they did not miss by much and the net result was a quarter where the company managed to turn a tiny profit, which is in stark contrast to the first couple of quarters for 2014. Unfortunately, AMD’s losses all stem from the desktop PC industry. Intel just had a record quarter, so there is certainly money to be made in this sector. We will have to see how Dr. Su, the new CEO of AMD, addresses this for the next quarter.

Source: AMD Investor Relations

81 Comments

View All Comments

silverblue - Friday, October 17, 2014 - link

AMD's revenue is going to drop simply because they don't have any new CPU nor GPU families to launch until Q1 2015, with the exception of little Carrizo over the next two months. Desktop Carrizo is due during H1 as is Pirate Islands, which is too late to make a difference to this year's financials.Mullins and Beema simply haven't had the success they deserve; when your only competitor sells their competing products at a loss to combat you, it's hardly surprising.

rocketbuddha - Friday, October 17, 2014 - link

While hindsight is 20-20, the main reason for AMD buying ATI is now clear. To serve Sony and Microsoft for their SOCs for PS4 and XB1 respectively. That part (has) worked well, but the "Fusion" part of applying the synergies to the PC market took far more time and caused AMD to hemorrhage money with a better CPU architecture (Core).Mark_gb - Friday, October 17, 2014 - link

AMD has a plan, and its not to sell ATI. ATI is at the corer of its plan.When it comes to chips for PC's, AMD's is weak. The old bulldozer is just too slow in too many benchmarks for most people or companies to want to buy. I know I have the first Intel chip in my system in almost 20 years right now. So whats the CPU plan? The K12... If the K12 chip is as good as AMD is hoping it is, when it is paired with the next version of the GPU AMD is working on, they might just be able to compete with Intel again. I say might because I have yet to see any benchmarks on the K12. I have no doubt that AMD can boost its GPU speeds.

Lisa Su, the new CEO at AMD is an engineer with an impressive background. She has pretty much been running the show for a while anyways, so lets give her some time to show us whats in the works. I believe that she is going to be able to put AMD's PC division back into the running against Intel, and turn that half of the company into a money maker.

melgross - Friday, October 17, 2014 - link

She is a pretty good pick. But what can she do, technically? If they haven't been able to do anything for years, it's not likely she will be able to do it now. And she' son in an engineering position, she's management.ppi - Friday, October 17, 2014 - link

What I mainly do not understand is, why right after they saw what kind of fiasco Bulldozer is, they did not start complete revamp of the architecture, but tried to optimize the Bulldozer. That optimisation is going forward, yes, but in such tiny steps, that Intel easily increases lead their i3 /facepalm.ShieTar - Friday, October 17, 2014 - link

You seem to missread their financial results. They have a big operating income of nearly 4.5% of their Revenue, and have similar results for years now. Don't be confused by the fact that their Net Income is lower. That is low by design, because you need to pay taxes on it. Much better to hand out your profits in the form of debt interest, i.e. tax-free profits.HighTech4US - Friday, October 17, 2014 - link

Quote: Don't be confused by the fact that their Net Income is lower. That is low by design, because you need to pay taxes on it.No it is lower because of the very large interest payments on their huge long term debt.

melgross - Friday, October 17, 2014 - link

Where do you guys come from? No company makes lower profits so that they can pay lower taxes. Debt interest? What are you talking about? You need to learn something about economics. They don't pay out "debt interest". There is no profit on debt. Depending on how it's is structured, they may get some taxes back on the debt interest they are paying, but they are still paying that interest. It has nothing to do with profits.HighTech4US - Saturday, October 18, 2014 - link

What are you babbling about.AMD has over $2 billion in debt. Interest has to be paid on that debt. That interest is subtracted from gross income resulting in lower net income.

ShieTar - Saturday, October 18, 2014 - link

As a matter of fact, most companies will make debt in order to lower taxable profit. Here is an article on Apple doing it openly last year, and commenting on it:http://www.bloomberg.com/news/2013-05-02/apple-avo...

What you are missing is this: The banks don't care if they get dividends on stock or interest on debt. Either way they are getting their return on investment. And the companies don't really care if they pay interest or dividends either, except for one detail: interest is paid before taxes, dividends are paid after taxes.

So yes, every large company will take debts it does not really need, just for the purpose on saving taxes.